Things to Consider When Choosing an Exchange Traded Fund (ETF)

There’s a plethora of options when it comes to choosing an Exchange Traded Fund (ETF) and the choice can be overwhelming. From whether to invest locally or globally, what sectors and asset classes to then choosing the actual ETF you are going to invest in.

Here are 9 things to consider when choosing an Exchange Traded Fund (ETF)

1. What is the management style?

One of the most common differences in ETF’s are whether they are passively invested or actively managed. Passive management is where the ETF tracks an index and provides a single share which can be traded whilst the market is open. Actively managed ETF’s track or mirror a managed fund where the fund manager selects the portfolio, underlying assets and amount invested in each and attempts to outperform an index or benchmark. Actively managed funds generally have higher fees than passively managed ETF’s.

2. If it's a passive investment, what index does it track?

You can invest in ETF’s in almost anything, tracking any number of indexes. The main two areas are indexes that track the overall market in a particular geographical location, for example, the United States or Australia and indexes that target a subset of the market. These subsets can be in a geographical location, such as small cap companies in the United States or Australia. The index could also track a specific sector such as technology, mining, financials or the full lithium cycle.

Whatever index the ETF tracks gives you an idea of what markets, sectors and industries you will have exposure to and enables you to see how it fits into your overall investment portfolio.

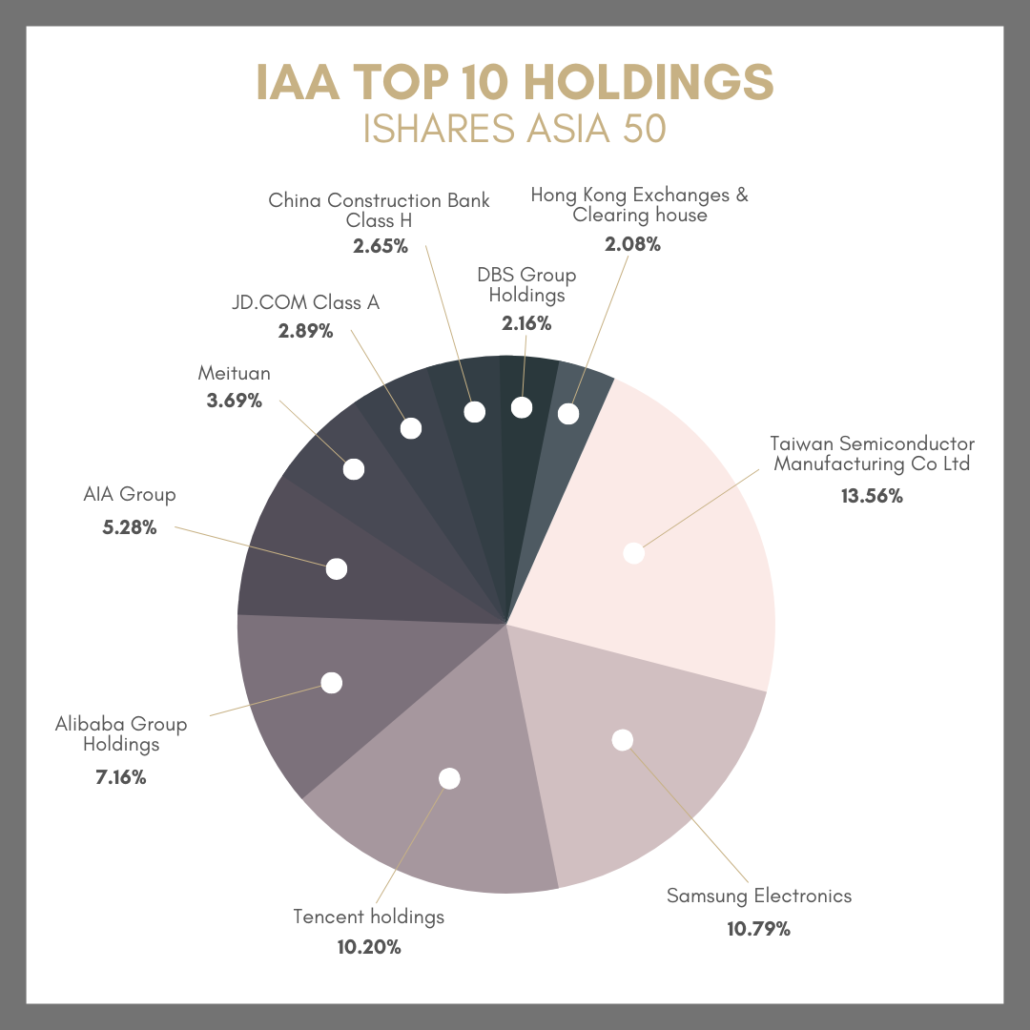

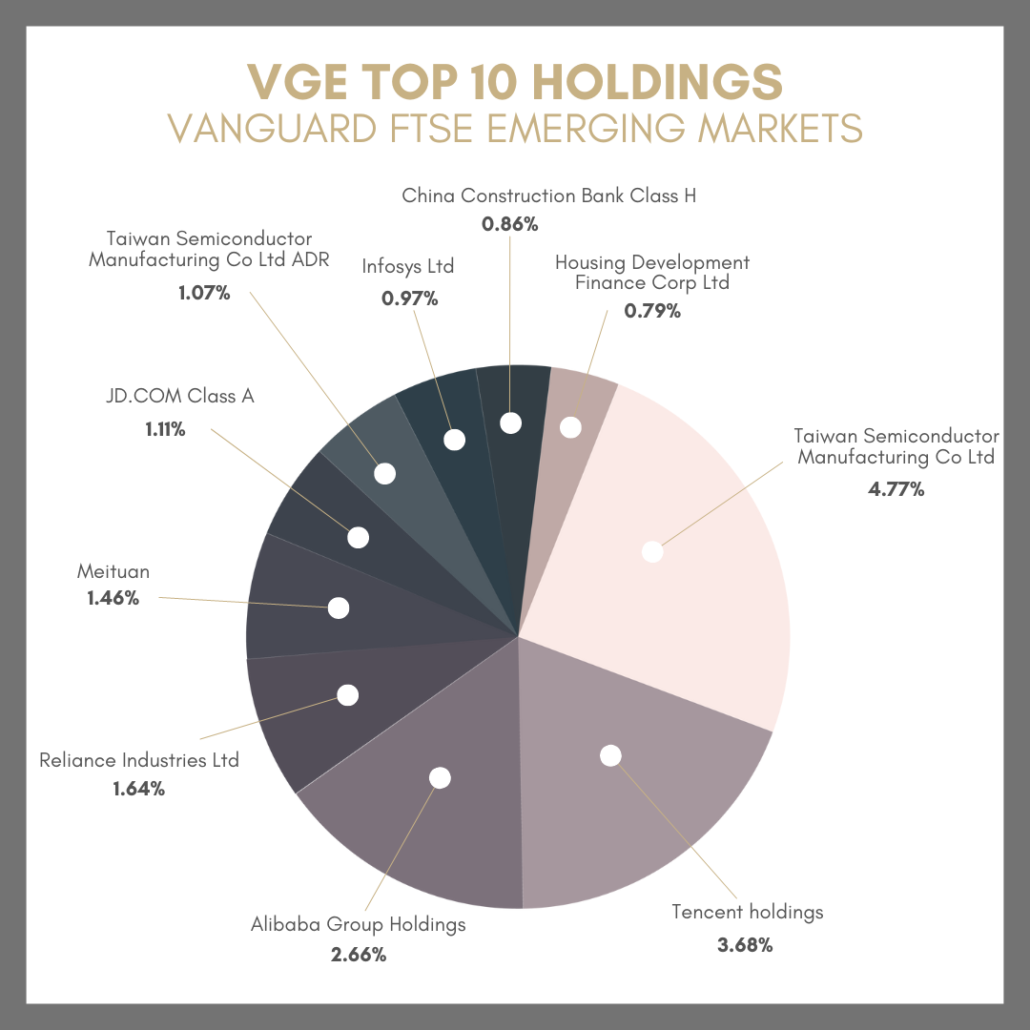

3. What are the top 10 underlying holdings?

When researching ETF’s, it’s important to know the top 10 underlying holdings. This allows you to ensure you aren’t unintentionally duplicating your holdings. For example, as illustrated below the iShares Asia 50 ETF (IAA) and the Vanguard FTSE Emerging Markets ETF (VGE) have some of the same companies in their top 10 underlying holdings despite tracking different indexes. IAA tracks the S&P Asia 50 and VGE tracks the FTSE Emerging Markets All Cap China A Inclusion index.

4. How does it fit into your overall portfolio?

When you are researching what ETF to either start your portfolio with or add to your portfolio, it’s important to consider your overall investment approach and how this ETF fits into it. Is it diversifying your portfolio or making it more concentrated by adding either the same companies or being in the same sector or geographical location? Looking at the top 10 underlying holdings (as described above) across the ETF’s you hold will help you identify this. You can read more about diversification over here.

5. What are the fees?

There will be fees associated with whatever investment you make and ETF’s are no exception. ETF’s that are passively managed and track an index generally have lower fees than actively managed funds. Fees make a big difference to your overall returns over time so consider whether the higher fees are worth it to you.

6. How liquid is the ETF? (aka how easy will it be to sell if you want to!)

There are two different components when it comes to liquidity in ETF’s, the trading volume on the exchange and the liquidity of the individual shares that make up the ETF. The trading volume shows the activity of investors, the number of people buying and selling on average per day.

The liquidity of the shares that make up the ETF may be more representative of the ease in which you’ll be able to trade and sell if you wish to. Let’s take a Real Estate Investment Trust ETF for example, which typically hold commercial, industrial or retail buildings. It may be more difficult to sell a commercial building (the underlying asset) in a depressed market when a number of shareholders wanted to withdraw their funds because buildings are less liquid.

7. Does it pay a dividend and what is the dividend yield?

When choosing an ETF, consider if it pays a dividend and what the dividend yield is. Dividends are cash payments paid to shareholders from company profits. The company is returning earnings to shareholders rather than using it for other means. The dividend yield shows how much a company pays to you relative to the share price and is the income you receive for holding the investment. Dividends form part of your overall return (the income component).

8. What is the base currency of the ETF?

Each ETF has a base currency which is usually the currency the ETF is domiciled in (which isn’t necessarily the location of the companies in which the ETF invests in). For example, an Australian domiciled ETF in Australian dollars may be investing in the S&P 500 which is the top 500 companies on the stock exchanges in the United States. You can also get United States domiciled ETF’s in USD that track the S&P 500. If you are investing in an ETF in another currency, you are exposed to currency risk as well. Fluctuations in the value of the currency can significantly impact your returns (both positively and negatively).

9. What is the fund inception date?

The date the fund began its operations is known as the fund inception date. The longer an ETF has been around, the more history of returns is available. Whilst past performance is not an indicator of future performance, you have more of an opportunity to see how an ETF has performed across a number of different economic climates for funds that have been around for a longer period of time.

Want to start investing in ETF's but don’t know where to start? Here's a breakdown of ETF’s across different geographical locations and sectors.

This is general information and for educational purposes only.