Harnessing the power of dividends can enable you to live off your dividends whilst your investments continue to grow! It can be a great tool in achieving financial freedom and meeting your financial freedom figure.

At the foundation, we have the ‘base level,’ which covers essential expenses. Moving up, there’s the ‘mid level,’ providing more comfort, and finally, the ‘so freaking amazing level,’ where dreams become reality!

So if your base level financial freedom figure is $30,000 and you have a dividend yield of 4%, this means you would need $750,000 in investable assets to achieve that $30,000 per year in income. But if your dividend yield or income component of your growth is 5% you only need $600,000 of investable assets to achieve your $30,000 yer year in income.

The calculation is simply your income level divided by the expected income return so if you’re receiving a 4% dividend and you want $30,000 per year in income, it’s 30,000 / 4% which is $750,000. This is all whilst your assets continue to grow.

Dividend shares provide a steady income stream in the form of dividend payments. Companies that pay dividends are established companies, mature companies that have a large and stable market share. So for example the large banks in Australia and large mining companies.

They have very established brands and large market share so they don’t have to invest as much money into growing the business. This means they’re able to return more of the earnings to shareholders. They’re considered blue chip shares which normally have a high market capitalisation.

Whereas growth shares are unlikely to pay dividends, this is typical of younger companies that are reinvesting their earnings into the business to grow it. People buy growth shares for the expectation that the companies will become profitable in the future and the share price will increase over time. But as we know, not all companies succeed so the risk is higher. Some growth shares do become dividend shares, but the question is knowing which ones.

Your returns are made up of capital growth or losses and income. The appreciation or depreciation of the share price represents your unrealised capital gain or loss (it becomes realised when you sell it). Your income comes from dividends or distributions in the case of ETFs which happens each year.

The tax you do or don’t pay also makes a difference (this is a bonus and shouldn’t be your main driver when investing as tax policy can change at any time – the same applies when investing in property, it needs to stand up on it’s own without the tax benefits). In Australia, imputation credits which are basically tax credits make dividends more attractive. This is where if the company pays the dividend out of money that they’ve already paid tax on, you receive a credit for the tax they’ve paid which is usually 30%. So if you’re tax rate is lower than that you will receive a credit for the tax the company has paid. However if your personal tax rate is higher than that you will need to pay the difference between the tax paid by the company and your tax at the higher rate.

When you own direct shares, you are a part owner in that business and if companies decide to pay some of their earnings to shareholders as dividends, you receive that money directly.

When you invest in those companies via an ETF rather than receiving the dividends individually those dividends are paid to the ETF provider and you receive your portion of the dividends they receive as a distribution. It’s a much simpler and more efficient way for them to be processed. With ETFs all income must be distributed to unit holders, the franking credits are also passed on.

The dividend yield is the total dividend paid for the year divided by the share price and is expressed as a percentage. If a company has a dividend yield of 5% and the share price is $100, they will pay $5 in dividends over the year. These are paid either quarterly, semi annually or annually depending on the company.

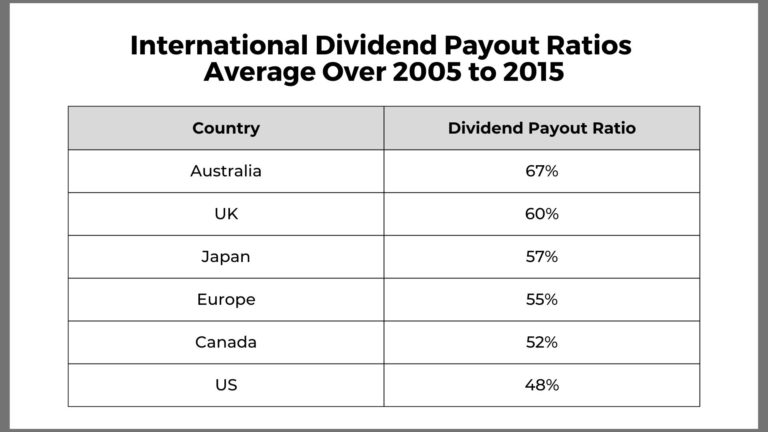

The dividend payout ratio measures how much a company pays in dividends versus its net income. A lower dividend payout ratio means the company is retaining earnings to reinvest in the business or to pay down debt. These ratios vary across companies and industries. Mature industries with steady cashflows can pay more of their earnings in dividends.

One of the main benefits of a having a portfolio with a high dividend yield is that you’re able to receive income without selling the asset. You have the opportunity to live off the dividends without triggering capital gains tax, however you will pay tax on the dividends and receive the imputation credit benefit in Australia.

It’s common for people to have a home bias when it comes to investing, after all we are more familiar with companies in our own country and the brands we interact with daily. In Australia, the tax benefits of dividend imputation encourages investing in Australian shares.

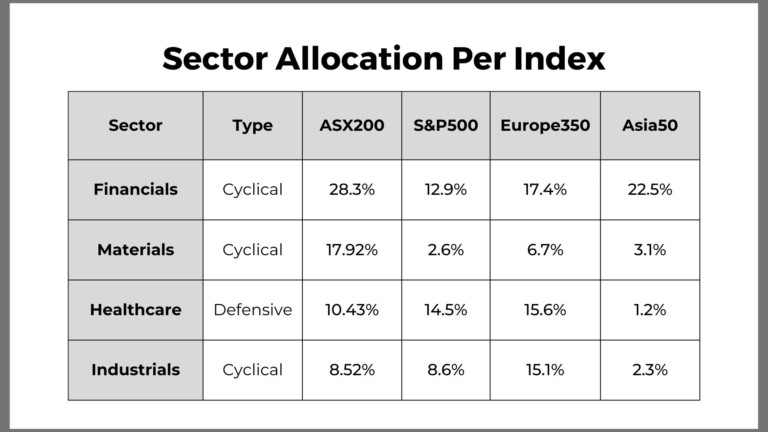

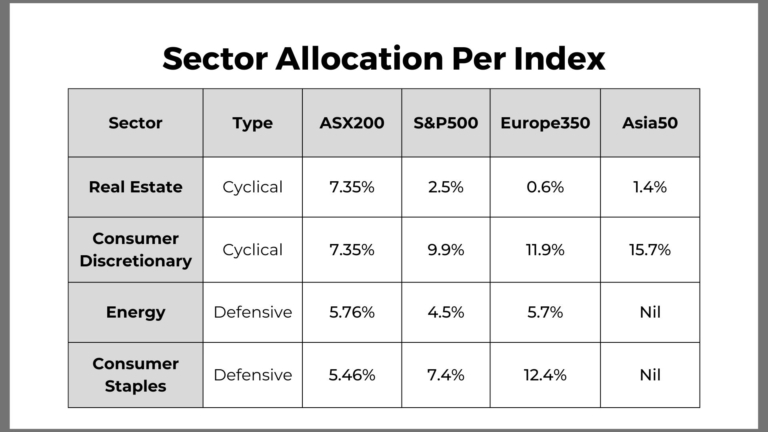

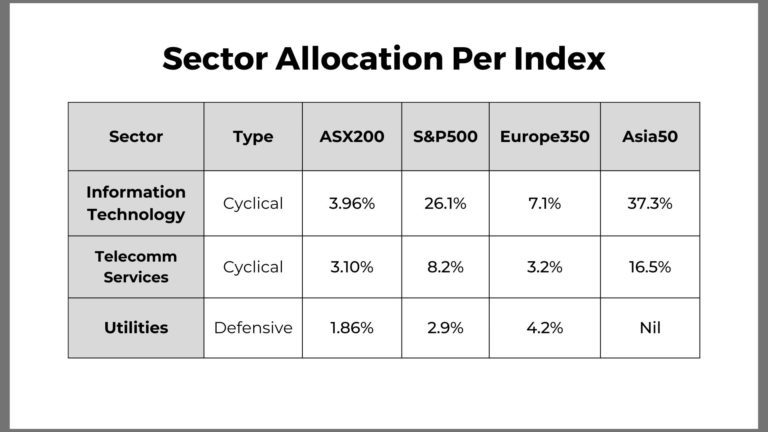

When considering a strategy that incorporates dividends into your portfolio it’s important to also consider diversification.

Take caution investing in individual stocks for dividends as a high dividend can be an indication of a falling share price. For example, only two of the top ten highest dividend shares in Australia from March 2022 are still in the top 10 now in July 2023.

If you are going to invest, it’s important to balance your desire for dividends with other investing factors such as overall return, diversification and avoiding a high concentration to specific sectors.

Join our community of empowered individuals by subscribing to our newsletter for more insightful content and valuable resources on building wealth and creating passive income.

This is general information and for educational purposes only.