Diversification – What is it

& Why is it Important?

An explanation of diversification, growth and defensive assets and different asset classes

Diversification can be described as not putting all your eggs in one basket and means allocating your funds/investment across different assets and asset classes to help manage risk. If you had all of your money invested in a single company and that company suffered irreparable damage and earnings fell, you would lose some and potentially all of your money. By having exposure to different asset classes across different geographical locations you are not betting on one particular company or even country. One of the easiest ways to create diversification in your portfolio is through investing in Exchange Traded Funds.

Diversification doesn’t guarantee positive returns, nor does it eliminate the risk of losing some or all of your initial capital. What it does do is minimise this risk and you are not solely reliant on one or a few assets.

First of all, let’s go through asset classes and the difference between growth and defensive assets.

Asset Classes

An asset class is a group of investments that have similar characteristics or traits. They often behave similarly to each other in the marketplace and have:

- similar risks and returns

- are subject to the same laws and regulations

- perform in a similar manner in particular market conditions

For example, Apple and Microsoft are both US stocks. Commonwealth Bank of Australia and Fortescue Metals Group are both Australian stocks.

Defensive assets

Defensive assets are suitable for investors who have:

- a short term outlook

- a low tolerance to risk

- a stable and low risk income.

- a minimum suggested timeframe of 1-3 years

Defensive assets include cash accounts, term deposits, savings/cheque accounts and cash management trusts. Fixed interest includes government bonds, corporate bonds, mortgages and hybrid securities which generally operate similarly to a loan. The income return is normally regular interest payments for an agreed period of time.

Growth assets

Growth assets offer the potential for higher returns, however are more volatile meaning price fluctuates more especially over the short time of 1-3 years. They include equities (also referred to as shares or stocks), property, and infrastructure.

Equities

Equities are partial ownership in a public limited company. The value is determined by the share price which moves up and down on any given day depending on a range of factors. If the company pays dividends, you will receive ongoing payments. Most large companies have the option of re-investing the dividend and purchasing more shares. They can be sub categorised into geographical locations eg Australia, the US, Europe, emerging markets, Asia. There is also companies classified as large caps (with caps standing for capitalisation), mid caps and mall caps. Sector based funds such as pharmaceuticals, mining, minerals, consumables etc. The characteristics of equities are:

- returns include capital growth or loss and income through dividends which can be franked (meaning the company has already paid tax on the earnings prior to the dividend being paid to you?

- part ownership of a company

- the minimum suggested timeframe is 5-7 years

Property

Property includes direct investments in residential, industrial or commercial property and indirect investments in listed property vehicles such as a Real Estate Investment Trusts (REITS) which can be listed on the stock exchange. The characteristics of property are:

- direct property has significantly higher entry and exit costs

- less liquid (you can't sell one room of a house!)

- the minimum suggested timeframe is 7+ years

Diversification means that you have a portion of your funds invested in different asset classes. How much you have in each asset class depends on your attitude to risk, your risk tolerance, how you feel about fluctuations in the value of your investment and market volatility as well as your investment time horizon which is how long you are going to have your money in the investment.

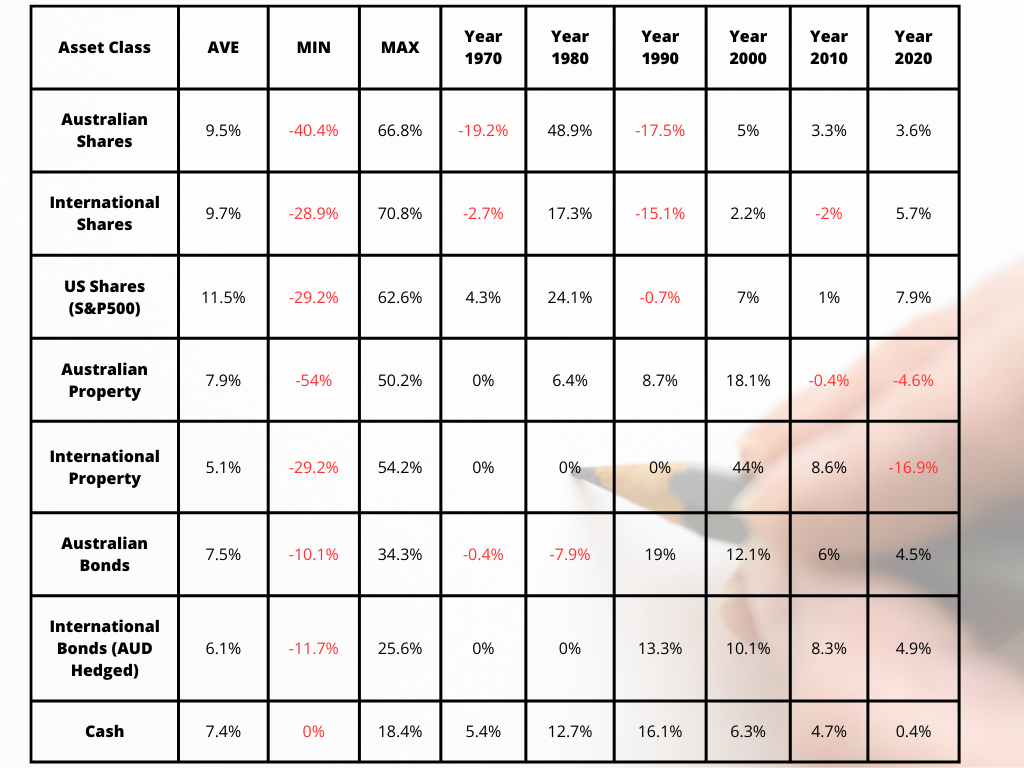

Returns can vary greatly across different asset classes in the same year. The table below outlines the average, minimum and maximum returns over a 50 year period, showing the average, minimum, maximum and the returns every 10 years. As you can see there are varying returns across different asset classes and years.

Historical returns are not indicative of future returns. This is general information and for educational purposes only.

Reference: https://insights.vanguard.com.au/static/asset-class/app.html