The Power of Knowing your Financial Freedom Figure

You might ask what is a financial freedom figure? It’s how much passive income you need to be able to have the choices and freedom to do whatever you want. Not in a lazy, sloth kind of way, but in a way where you no longer need to work just to pay the bills, you get to do work you love because you’re passionate about it.

Where your expenses are met without you having to do anything, it’s truly passive. It’s not having a biz you can’t take time off from anymore than working for someone else. It’s not anything that you have to show up for and do something. It’s true passive income.

A business that is managed by other people and takes very little involvement from you, an investment property that is managed and is putting money into your bank account, dividends from shares, interest from cash or fixed interest.

Think about the amount of money you need to live off, I like to break it down into three levels. Your base level, mid level and so freaking amazing financial freedom figures.

- Your base level financial freedom figure, this covers your basic expenses (rent/accomodation, groceries, insurances, transport, a basic amount of entertainment.

- Your mid level financial freedom figure includes everything in your base level plus a little bit more. Eating out, more activities.

- Then, there’s your so freaking incredible lifestyle where you get to travel a lot, support loved ones, donate to charities you care about and generally live an amazing life.

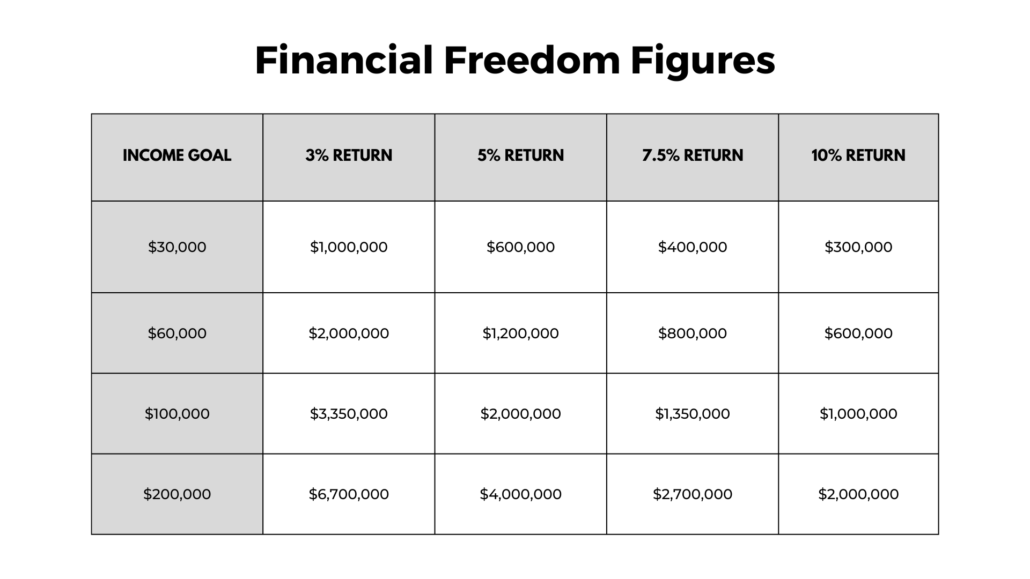

Let’s say your base level lifestyle is $30,000 per year and you have a 3% income return, you would need to have $1 million in assets invested.

Increase that return to 5% and the assets required become $600,000..

Want $60,000 per year and you’re getting a 5% return? You’ll need $1.2 million in assets!

Here’s a summary of the amount of investable assets required at different income levels.

Now I know that having $1 million invested may seem quite out of reach right now if you are just starting investing. So start where you’re at, focus on consistently investing and dollar cost averaging into shares or Exchange Traded Funds.

Start with a goal of $500 per year of passive income, that’s $10,000 of investable assets at 5% dividends or $16,666 investable assets at 3% dividends.

Then aim for$1,000 per year in passive income? Then imagine that increases to $2,000, then $4,000 then $8,000.

It would quite literally change your life! Focus on acquiring income producing assets that generate a passive income

Inside of Financial Freedom Fundamentals I teach my clients how to create passive income and increase their net worth. They not only have automated systems that work for them, they create overflow and have so much joy and happiness in their lives. All on the way to creating financial freedom.

This is general information and for educational purposes only.